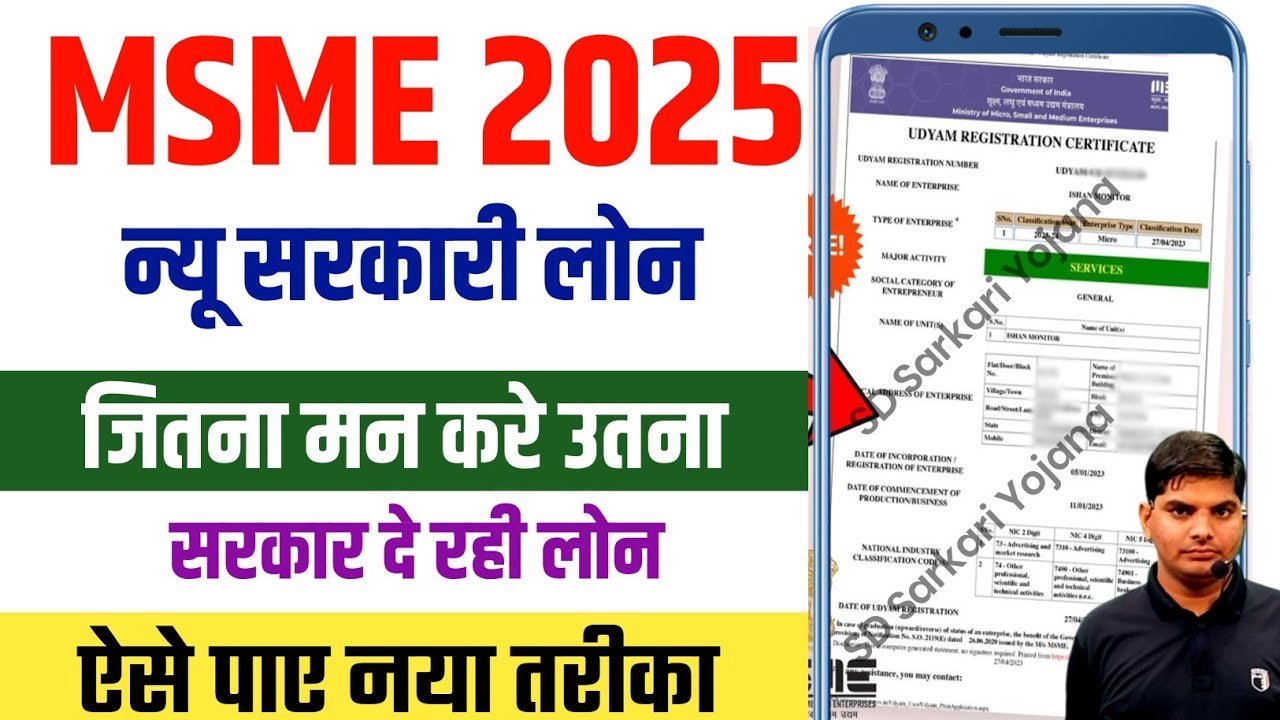

MSME stands for Micro, Small, and Medium Enterprises, and the Ministry of MSME is a dedicated department of the Indian government that provides financial support, loans, and subsidies to promote local businesses and startups.

💡 Why MSME Loans Matter?

- Helps boost local manufacturing under Make in India and Self-Reliant India initiatives.

- Provides capital support to small entrepreneurs who lack financial backing.

- Encourages youth and middle-class individuals to start their own ventures.

💰 MSME Loan Benefits in 2025

| Feature | Details |

| Loan Amount | ₹50,000 to ₹50 crore |

| Subsidy | Up to 35% (e.g. ₹7 lakh subsidy on ₹20 lakh loan) |

| Interest Rebate | 2% discount for timely repayment |

| No Collateral Required | For smaller loans up to ₹25 lakh |

| Loan Schemes Covered | PMEGP, PM Mudra Loan, PM Vishwakarma, etc. |

📌 Types of MSME Loan Schemes

- PMEGP (Prime Minister Employment Generation Programme)

- PM Mudra Loan (Shishu, Kishor, Tarun categories)

- Vishwakarma Yojana

- Startup India Subsidized Loans

These schemes can be applied through MSME portal or dedicated government platforms.

📝 Eligibility for MSME Loan 2025

- Any Indian citizen with a business idea or running business

- Age: 18 years and above

- Must have Aadhaar, PAN, and Bank Account

- For some schemes, 8th pass or skill certification may be required

- Loans available for individuals, proprietors, or registered enterprises

🖥️ How to Apply for MSME Loan Online (Step-by-Step)

✅ Option 1: Through Official MSME Portal

- Visit https://msme.gov.in

- Click on Apply Loan or go to Schemes > Credit Support

- Choose the scheme you’re eligible for (PMEGP, Mudra, etc.)

- Register using your mobile number and email

- Fill the loan application form with:

- Business plan

- Loan amount

- Documents (Aadhaar, PAN, Bank Statement)

- Submit for verification and await approval

✅ Option 2: Through Jansamarth Portal

- Go to https://www.jansamarth.in

- Click on Business Activity Loan

- Fill eligibility form:

- Business nature (New or Existing)

- Investment amount

- Loan required

- Upload necessary KYC and income proof

- Get instant eligibility result and apply online

📄 Documents Required

- Aadhaar Card

- PAN Card

- Bank Passbook or Account Details

- Business Plan (for higher loans)

- Income Details or GST (if applicable)

🧾 Subsidy and Repayment Advantage

If you repay your MSME loan on time, you get:

- Up to 35% subsidy (non-refundable)

- Interest rebates (e.g. 2%)

- Waiver of some EMI amounts in select schemes

📞 Support and Help

- Join the official MSME WhatsApp or Telegram groups for updates

- For personalized support, reach out via the MSME Helpline on the portal

🏁 Final Words

MSME Loan 2025 is a powerful opportunity to launch or grow your business. Whether you are a tailor, trader, IT professional, or manufacturer, the government is offering substantial loan support with subsidies.

✅ Apply today through the MSME Portal or Jansamarth Portal 📅 Don’t delay—funds are being disbursed regularly and no collateral is required for smaller loans.

Also Read :How to Download Ayushman Card from Mobile in 2025 – Step-by-Step Guide