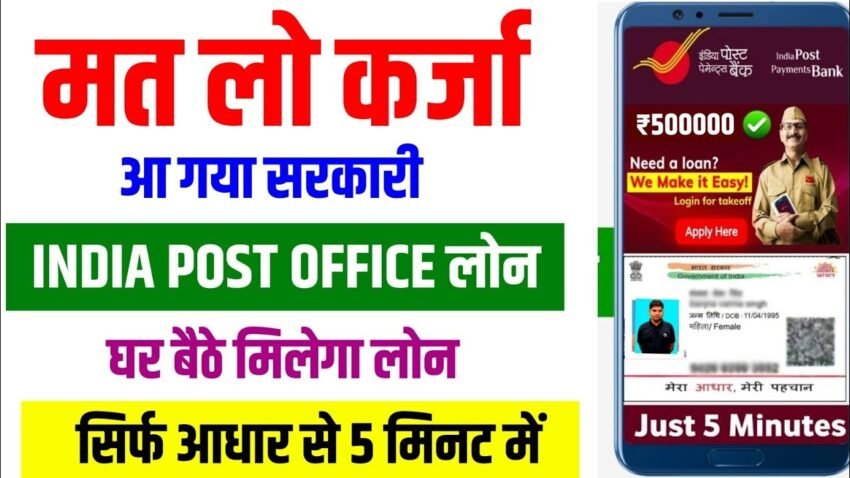

How to Apply for an India Post Payment Bank Loan in 2025 – Full Guide

If you’re looking for a trusted and convenient way to get a personal loan up to ₹5 lakh, the India Post Payment Bank (IPPB) now offers an easy, fully online process. Whether you’re sitting at home or on the go, you can apply directly through your mobile phone without visiting a branch.

Here’s a complete step-by-step breakdown on how to apply for a Post Office personal loan in 2025.

✅ Loan Highlights

- Loan Amount: Up to ₹5,00,000

- Partner Lenders: Five, Axis Bank, HDFC (via IPPB)

- Interest Rate: Low and flexible

- Processing Time: 3–24 hours

- No branch visit required

📲 Step-by-Step Loan Application Process

-

Open Google and Search “Post Office Loan”

- Type “Post Office Loan” in Google

- Click the link for India Post Payment Bank official portal

-

Click “Apply Now” on the IPPB Portal

- You’ll be redirected to the partner loan platform (e.g., Five)

- Select Loan Category: Personal Loan

- Enter your PIN code, mobile number, and complete the captcha

- Click Get OTP, then verify using the OTP sent to your mobile

-

Start Loan Application with the Lending Partner

- Click Apply Now after OTP verification

- Fill in the form with:

- First name and last name

- Gender

- Employment type (e.g., salaried)

- Monthly salary (Minimum ₹35,000 recommended)

- PAN card number

- Date of birth and age

-

Submit Personal & Employment Details

- Mention your relationship status (Single/Married)

- Provide complete address details

- Click Save and Proceed

🏦 Upload Required Documents

-

Upload 3-Month Bank Statement

- Choose the bank where you want the loan amount credited

- Upload the latest 3-month bank statement

-

Provide KYC Details via Aadhaar

- Enter your Aadhaar number

- IPPB will perform KYC verification through DigiLocker

- Re-enter bank details for fund disbursement

✅ Final Submission & Disbursal

- After all details are submitted, click Final Submit

- You will receive confirmation:

“Greetings from IPPB. Your loan request has been successfully submitted.” - The loan amount will be credited to your bank account:

- Within 3 to 4 hours, or

- Max 24 hours

📌 Key Points to Remember

- No need for Axis or HDFC account – Only India Post Payment Bank account is needed

- Ensure your PAN and Aadhaar are valid and linked

- Maintain minimum ₹35,000 salary for faster approval

- Provide correct and active mobile number for OTPs

- Join official Telegram/WhatsApp groups for updates (as shared in the video description)

Conclusion

In 2025, taking a personal loan from the Post Office is quick, secure, and 100% digital. If you’re looking to avoid private lenders and prefer a government-backed option, IPPB via India Post is one of the most trusted ways to get instant funding.

Also Read :How to Do LPG Gas eKYC Online and Check Gas Subsidy in 2025 – Complete Mobile Guide